Todd: "I know I shouldn't touch my retirement savings, but this time it is different. It's a pandemic."

Willow: "Yes, you are right, this time is different. Every time is different. Every recession has started differently. And while there are no certainties, so far, they have all ended the same."

Continue reading to learn more from Wise Willow, our newest neighbor on Logic Lane.

Hello Friends,

We have made it this far. How are you doing? Who knew a simple question could be so complicated to answer these days. For many people, the response depends on day or even the hour of the day. We have spoken with many people over the past few weeks and here are some of the most accurate responses we have received:

1) Terrible. Thanks for Asking.

2) As well as could be expected.

3) Next question.

4) Oh everything is good. The kids are fine, work is OK, everyone is safe for now.

Just counting our blessings because we know this could be a lot worse.... You just told me how are things and I am asking how are you?

One person we spoke with answered the question of how they were doing by discussing the Stockdale Paradox. We found it to be applicable and inspiring to our circumstances today. And, we are pretty certain Jim Stockdale, if alive, would take residence on Logic Lane.

As Admiral Jim Stockdale, the highest ranking officer at the Hanoi Hilton explains, "It is the optimists that have the hardest time.You must never ever, ever confuse, on the one hand, the need for absolute, unwavering faith that you can prevail despite those constraints with, on the other hand, the need for the discipline to begin by confronting the brutal facts, whatever they are."

While we realize that being asked to not leave our homes and being held captive with three children under the age six should not be compared to the Hanoi Hilton, the advice of Admiral Stockdale is timeless and relevant. We are balancing realism with optimism and taking the new circumstances day by day.

In regards to the impact on the global stock markets, it is important to remember the perseverance and creativity of the human spirit. Amazing inventions, companies and ideas emerge from our nation's most trying times. Microsoft, IBM, Disney and Trader Joe's and more recently, Venmo and Pinterest, were all born from recessions. There is a reason for hope.

Recessions do imply volatility and when money doesn't only go up, emotions can take over and mistakes can be made. No one enjoys seeing their investments worth less and as we have discussed, if risk was the only result investments provided, we wouldn't do this. The reason we invest is for the return, and we tolerate the risk.The expected rate of return that owning a low cost, diversified portfolio provides is why we don't put all our money in our local savings bank. We believe that over time, the trend will be positive, and in the meantime, we are asked to be disciplined. We also understand that our investments are one part of a well designed financial plan. Investments are tools for future wealth accumulation and we have many other tools in our financial plan for immediate financial security.

Over the past few weeks, we have introduced you to all the logical, financially astute neighbors on Logic Lane. The creation of this fictional land is designed to be informative and lighthearted in a climate that is already serious enough. All the strategies from Volume I and Volume II should still be considered. Tax loss harvesting, Roth IRA conversions, opportunities with available cash, refinancing, and purging outdated financial documents are all strategies to consider implementing. If you have not read the first two volumes, be sure to check out all the interesting neighbors that have been introduced.

This week, we will still spend time on Logic Lane, but we are also turning the corner to Senseless Street. The residents of Senseless Street are fun, kind people and always the ones you want at the neighborhood party, just not the kind you would seek out for financial guidance. They love anything that will deliver immediate results - infomercial products, fad diets, and making poorly reasoned decisions are some of their favorite things. Let's see what everyone is up to...

Senseless Street

Meet Todd the Timer - Todd is giving advice to anyone who will listen, and that isn't many since his strategies to date don't have a strong track record. Todd even once bet against the Harlem Globetrotters. He goes on about how he should have sold at the market high back in February. One of the residents on Logic Lane, Willow, reminds him that the stock market on average hits a new high 11 times per year. That means the strategy he would take is to sell out of his entire portfolio 11 times every year and then, presumably, buy it back when it is higher? She asks the question but he moves on to the next topic. Todd likes emotion and rambling, not logical questions. Now, his newest idea. He is going to take what he has and move everything to cash. When asked if this is a permanent decision? Or will you reinvest your money at some point? Todd is in fact, only 56. "Of course I will get back in. What, do you think I want to work forever? But I am going to wait until ya know, when the dust settles, when the coast is clear, when things have calmed down." Willow asks him another question, "So the coast will be clear, and you will feel better, when things are a lot worse than they are today? Because otherwise aren't you saying that your strategy is to sell everything now and buy it back when things have calmed down and everything is higher and more expensive?" Once again, Todd, your guidance is incomplete and underwhelming.

Meet Impatient Ian - Ian doesn't like to wait for anything. Who has time to wait? His impatience serves him well in filing his taxes as early as possible, finishing his Christmas shopping in September and playing Whack a Mole at the arcade, but not when it comes to baking, gardening, or investing. Ian doesn't like things that take time. A recipe that calls for 60 minutes at 350 degrees? Who has 60 minutes to wait to eat something? Not Ian. He chooses to bake his recipes for 30 minutes at 500 degrees. Not only is Ian's food horrible, he is also a really bad investor. Why? Because building wealth takes decades. Ian checks his retirement portfolio every single day, he loses sleep if he doesn't change something regularly, and he routinely makes what should be permanent decisions on temporary feelings. He doesn't realize that financial success is a long, monotonous journey. There is no escalator, you have to use the stairs. He doesn't wait to listen about climbing stairs, he is too busy working on his physique with recipes in his new Instapot.

Logic Lane

Meet Wise Willow - Willow lives at the end of Logic Lane in the least expensive house in her neighborhood. Not only is she wise, she is highly practical. She is consistently sought out by her family, friends and neighbors for guidance because her advice is timeless. She is an old soul and a cornerstone of the community. She was in her lawn chair for the social distancing happy hour in front of her house and got to talking about this concept of your future self and money.

Everyone stopped to listen. She explained that the money you use today is for consumption. You need money to buy your groceries, pay your mortgage, put gas in your car, etc. If all you used your money for was consumption today, there would be nothing left over to even worry about. But, that is not how the world works.

People save and invest for their future. They save and invest their money for their future selves. She said just as she makes her bed every morning and thinks to herself, "Future Willow is going to love this tonight when she arrives at a neatly made, inviting bed," she applies the same logic to investing. Her invested money is for her future self. She continues. So yes, when I see the money I have worked so hard to save and invest, decrease in value, does it make me happy? No it doesn't. But the role of my investments is not for my current happiness or current financial security. I don't need all that money today for my use. It is for my future self. If I make a short sighted decision to sell my investments because I don't like how they feel today, I will probably give myself one amazing, peaceful, restorative night of sleep. But, when I wake up tomorrow, I will realize I have not eliminated my problem but rather given myself another, bigger problem. See, my intention is to reinvest, because my future self needs that money to grow over time. There is a trade off to every decision. The cost of that decision is not free. The cost of that one night of sleep was very high. I took from my future self to appease myself today. Instead, to appease my current self, I should have walked over to the pan of Ian's horrible brownies he dropped off a few days ago, and cut off a slice and enjoyed it staring blankly at the wall. That would have had a lot less damage. Sorry Ian, your baking is quite awful.

Meet Practical Peter - Peter is taking this time to revisit his legacy plan and is getting his financial house in order. Peter is 58 and his most cherished possession is a three minute recording of his mom talking. She died in 1997 and it never occurred to him when she was alive to ever record her saying anything. But, the power of hearing her words and hearing her voice is a gift he cherishes. The recording is not of anything special, but hearing her laugh and her words calms and centers him, no matter what is going on in the world. Peter is figuring out how to record videos of himself and upload them to the cloud so he can leave words of wisdom for his children. His first question he is answering, "What was the most valuable advice your mom gave you?" He feels a little awkward doing it, but knows that he won't regret creating this for his children.

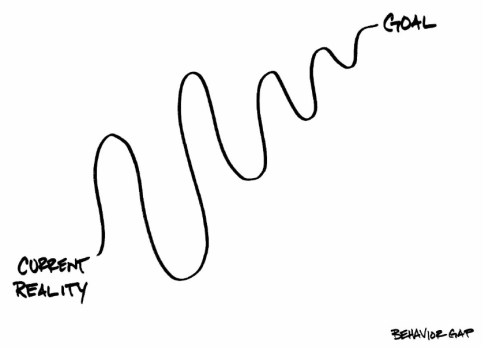

Meet Pema and Patrick the (attempting to be) Patient Parents - Pema and Patrick have never had less time, homeschooling their three children and working from home. They haven't opened their online portal to look at their investment and retirement accounts. The only thing they did notice is a lower credit card bill since they have a hard time finding ways to spend money these days. They have a health cash reserve so they are considering using the money they saved to fund their IRAs for 2020. They have until April 2021 but they figure if they have the money, the sooner the better to put it to work. So why are they not concerned that their investments are now worth less than they were a few months ago? They don't have to be. First, they know that wealth accumulation is not a straight line.

They have a plan for this. They work with a financial planner for many years and she is rebalancing their accounts, tax loss harvesting and she also works with their parents who are doing a Roth conversion.

They are also attempting to leverage the myriad of tools available to enrich their kids' learning, but when Pema attempted a YouTube art class, their four year old knocked her laptop off the table and shattered it. She views this as a sign from the universe that she is not meant to be her children's teacher. We agree Pema.

While these are fictional characters, the YouTube/shattered laptop did occur at the Raines' house. All children survived.

If you made it all this way, we hope you had some laughs and have a few ideas to reflect on the next couple days. Be it thinking more about your investments for your future self, documenting part of your wisdom for others, or taking advantage of all the financial planning opportunities this time affords. And, as always, if you think friends or family would find this information valuable, please feel free to share.

Our next newsletter will be walking through the key provisions of the recently passed CARES Act.

All our best and until next time,

Christy

The preceding are hypothetical case studies and are for illustrative purposes only. Actual performance and results will vary. These case studies do not constitute a recommendation as to the suitability of any investment for any person or persons having circumstances similar to those portrayed, and a financial advisor should be consulted for your specific situation.