A Voice of Calm and Reason on Logic Lane

Welcome back to Logic Lane, where the neighbors are emerging to a beautiful summer, and they have a lot on their minds. Logic Lane is where we go to learn timeless lessons from our friends and neighbors and gain insightful, and occasionally humorous, perspective about all the happenings in the world. From rising inflation, the ongoing pandemic, Russia’s invasion of Ukraine, increasing gas and grocery prices, declining stock market indexes, and interest rate increases, there is no shortage of angst producing topics to bring up at the community mailbox. While many of the neighbors are either too busy with their own families to worry about things outside of their control or are more interested in planning the next happy hour, or discussing upcoming travels and grandchildren, they do realize that this is an interesting time and there is plenty to gossip about.

We start our stroll down Logic Lane with Timing Tom who decided that cashing in on the housing market was a solid strategy for his family. Next is Reasonable Ralph, and his dog Peaches, who reflect together on if an investment is no longer at its high water mark, does it make it bad to own? Following Ralph, we learn about Worrying William and his questionable choice of outerwear and finally, Concerned Carla and Calvin who are retiring this summer after a 40 year career.

To prime our minds for the stories ahead, ponder this question

I have made the wisest choices I am most proud of in my life and reflect on with a sense of accomplishment and no regret when:

a) I was panicking

b) I was swept up in the mania of something

c) I was copying what my neighbor did

d) I was following a thoughtfully designed plan which allowed me to live my most intentional, fulfilling life

Fair, a trick question. But when we are in uncertain, unwelcome times and need encouragement to focus the bigger picture and why we voluntarily put ourselves through the volatility of owning investments, it can be helpful to take a breath and zoom out. For clients of our firm, if at any time revisiting the plan we have designed for your circumstances and personalized perspective would help, know that we are here to help you and you are not alone. We are in this together and the future is bright in so many ways

TIMING TOM

Tom is currently renting a house on Logic Lane and received a 20% rent increase notice for his upcoming renewal. Tom is renting because he sold his primary residence in 2021, expecting that the housing market would crash and he would be able to scoop up a new place for his family to live at a smoking deal.

Tom is still waiting for the crash. He is convinced it is right around the corner, all while the house he sold last year increased in value another 20% in the last 12 months, which only means he must wait that much longer to buy back at the price he sold for. He also gave up his 2.75% mortgage to pay a much higher rent for the foreseeable future. Timing Tom is excelling at replacing one problem with another problem and is too busy to talk about it because he is searching Zillow for a new rental to relocate his family of five. Odds are he won’t be living on Logic Lane for long. But, whenever he does buy again, you can be certain the only story that will be told is how he, “Cashed in for X and grabbed a deal for Y.” The price of panic – stress, uncertainty, time, transaction costs, moving costs, taxes, cognitive load, family inconvenience of moving, change in interest rates, heart palpitations and sleepless nights, obviously excluded from the highlight reel.

Tom’s brother-in-law, James Clear, encouraged him to think about this concept of the price of panic and not only to consider “How much could I lose if I don’t sell my house at what I think is the peak of the market?” But to also to consider, “If I make this choice, how much time could I lose? How much sanity could I lose? How much reputation could I lose? How much happiness could I lose?” He reminded him that opportunity cost is about a lot more than money. Tom was too worried to see if the new listing on Zillow’s rent price included utilities to let the wisdom sink in.

REASONABLE RALPH

Emerging next from home is Reasonable Ralph. Ralph overhears Timing Tom on his front porch, talking on the phone saying how, “he cannot believe how terrible the stock market is.”

Reasonable Ralph reflects on the statement as he takes his golden retriever, Peaches, for a walk. “Is the stock market terrible?” Ralph thinks about his own experience investing, which has been long and filled with prizes and punishments. He thinks to when he was young and of the mistakes he made picking stocks and realized his crystal ball was unfortunately and expensively out of order. He learned the hard way that any great investment can look downright terrible over short time periods.

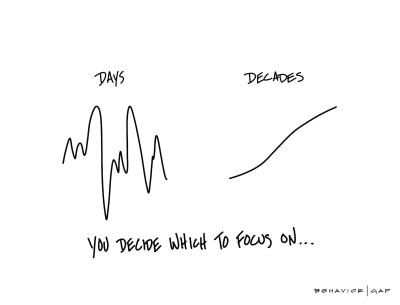

Since then, Reasonable Ralph has taken the mindset that when evaluating his investments, he chooses to focus on his personal time period of decades, not days. He mentally zooms out. He reflects to his 401k that he rolled over into an IRA when he changed companies in 2012. 10 years ago the investments were valued at $600,000 and at the end of 2021 the investments had grown in value to $1.3 million having averaged about an 8% rate of return in an aggressive, diversified portfolio. Today (late May 2022) the same investments are worth $1.1 million. He looks down at Peaches and asks the rhetorical question, “Is something that increased in value from $600,000 to $1.1 million over 10 years a terrible investment? Would it have been a great investment if it was still $1.3 million? My investments have decreased in value $200,000 or about 15% this year. Does that mean they are all now terrible?”

Ralph takes a deep breath. “Should I only focus on the high water mark of my investments, convincing myself that is the new floor of what my accounts should be forever going forward? Is my entire financial life, and my personal sense of contentment, teetering on the highest value my investments ever achieved?”

The thought crosses his mind if he should be applying the same logic to another important number, the one on the scale. And should he only be judging his personal value based on the most money his investments were ever worth and the fittest he ever was? Is everything other than that a disappointment? He sure hopes not. But he does think he might want to turn his walk into a jog…

He laughs and shakes his head at the irony of the commencement speech he heard at his niece’s college graduation over the weekend, advising the new graduates to avoid the common traps of adulthood which will routinely present the holy grail of accumulation. Accumulate money, accumulate income, accumulate status, accumulate possessions, and then adjust the bar. Accumulate and move the goal post. Never stop to ask if it is enough or to celebrate what you have accomplished. Is that not the same thing he is wrestling with now as a 60 year old man?

He reminds himself, and Peaches, that something that only ever increases in value is not an investment, but instead that is called a guarantee. Wealth accumulation, and life, is not a straight line up and to the right. And while some companies will issue “guarantees” they come with their own set of problems. His optional choice to invest his money has rewarded him over his lifetime and he has no reason to believe that, if evaluating them with the appropriate measuring stick, that they won’t continue to reward him for the risk he chooses to take.

While Reasonable, Ralph is human and knows that he doesn’t invest because he looks forward to times like these. The world feels pretty nuts right now. The reason he chooses to invest is for long term wealth accumulation, compounding he couldn’t achieve in his checking account. And unfortunately, when that compounding will happen, and when the returns which make it worthwhile will materialize, is unpredictable. If he could simply consistently and accurately predict the cause, length, and direction of every market cycle, this would all be so easy. But, he has read that those crystal balls are having a supply chain shortage and are on back order. Shoot. As Morgan Housel, author of the Psychology of Money teaches us, “Everything worthwhile in investing comes from compounding. And compounding is just returns leveraged with time. The time component of compounding is why 99% of Warren Buffett’s net worth came after his 50th birthday, and 97% came after he turned 65.” Pretty remarkable to think about. And, as his business partner Charlie Munger comments, “The first rule of compounding is to never interrupt it unnecessarily.”

Reasonable Ralph decides that maybe his neighbor Tom doesn’t have it all figured out by declaring that “the stock market is terrible.” Context matters. Sure, 2022 hasn’t been a good year so far for his investments and he doesn’t know how long it could last, but Reasonable Ralph is using his own measuring stick to evaluate what works for him.

WORRYING WILLIAM

Coming around the corner to greet Reasonable Ralph is Worrying William in his trademark umbrella hat. William loves to worry. While Logic Lane’s average annual precipitation is about 15 inches, “You never know when those days will come, and the weather people never get it right.” So, William chooses to spend every day looking ridiculous because he knows that it will rain, just a matter of when.

William stops Ralph as he is about to walk into the dog park, “Can you believe how out of control this inflation is?!? Gas is now $4.30 a gallon!” Reasonable Ralph first responds by asking William if he knew that one town over the gas was only $4.15 a gallon, just to get him fired up, because he makes it too easy and too fun to do. Ralph then responded reasonably that his monthly spending on gas is roughly $300 and a 50% increase in gas prices would be going to $450 per month. For him, that additional $150 is about 1% of his current monthly income. He still isn’t spending to his pre-pandemic levels and with the amount he didn’t spend for two years, he is confident he will be able to absorb this relative increase in price. Unsatisfied, Worrying William tells Ralph he has to go to the grocery store to buy more toilet paper because he knows that another shortage is just around the corner. And you can never be too prepared.

CONCERNED CALVIN AND CARLA

Our last neighbors on Logic Lane are Concerned Calvin and Carla, who are 67 years old and preparing for Carla’s retirement and nervous about what the future holds with no steady paycheck and living off their investments. They thought making it through the past two years of the pandemic were stressful and now to be looking at a retirement with such an uncertain world, they are wondering if they should reconsider her retirement. All the money they have saved for the past 40 years has all seemed like funny money up until this point. Calvin reminds Carla that “Odds are, this is the biggest decline since the last big decline you neither remember nor care about anymore,” but it feels different. Saving it was easy. Spending it feels different.

When they take a step back, they realize that making the optional choice to invest their money for the past 40 years has allowed them to multiply their wealth in ways their paychecks and checking accounts never could. They have all these different vehicles – checking and savings accounts, home equity, investment accounts, retirement accounts, insurance policies, and they all serve different purposes in their lives. Because they know themselves, they have always kept a significant “war chest” of cash well beyond the 6-month emergency fund. They also have chosen to take a less exciting, slower ride to wealth accumulation by not investing all their money in higher risk investments. They realize they could potentially have more of one asset, money, by taking more risk, but they have more of another asset, sleep, by taking less.

As they look at how they are invested, the $4 million their investments were valued at the end of 2021 is now at $3.5 million, a reduction of 12.5%. Calvin nudges Carla as they can’t believe their investments can be +/- $500,000 when they never made that much income in any given year working. When they put their plan together at the start of the year, with some reasonable assumptions1 they planned on starting monthly withdrawals of $13,000 per month. In addition to their Social Security checks of $4,500 total, this would give them a total retirement income of about $17,500 per month. They realize that fluctuations in their investments are inevitable, and their retirement plan has guardrails and bumpers built in. Not only can they adjust their withdrawals to maintain the health of their portfolio, but they also have a clear understanding of their spending to support their lifestyle which can fluctuate as well. Their bills are about $2,000 per month and their credit card averages around $10,000 per month. They are making small adjustments now to protect the long term health of their portfolio. With the current lower value of their investments, which they have the confidence will rebound over their 25+ year retirement, they intend to start their monthly withdrawals at $12,000 instead of $13,000. Their total monthly income will be $16,500 which after taxes will be little over $13,000 per month. They feel comfortable that they will decrease or increase that as needed and as the ever changing circumstances allow.

They take a deep breath and remember all the other unwelcome events they have weathered and have all the confidence in the world they will make it through these times. They make a choice to stop thinking about it, put on some music and get back to preparing lasagna, salad, brownies, and a package of water guns and bubbles for their neighbors around the corner who are a military family. The mom’s Air Force squadron was recently deployed to Poland for three months and dad is home with the two young boys. Calvin and Carla are always looking at ways outside of themselves to take action to help others. Not only does it help another family, it gives them a sense of great happiness knowing they are getting busy with their hands and hearts to help others and get their head out of their own worries. It doesn’t take much for them to recall the love that was shown to them by their friends when Calvin was going through his cancer treatments three years ago and all the neighbors made sure their fridge was never empty, the driveway was cleared, grass was cut and fresh mulch was in the flower beds. They won’t be leaving Logic Lane anytime soon.

We hope you have enjoyed this stroll through our favorite neighborhood and have found a piece of timeless wisdom to give yourself fresh perspective during this time. We hope you have a wonderful summer, can spend lots of time outdoors and with those you love and as always, we are here for any questions you may have.

These are hypothetical examples and is for illustrative purposes only. No specific investments were used in these examples. Actual results will vary. Past performance does not guarantee future results

1 – hypothetical rate of return of 6%, inflation of 2%, life expectancy of 95